Posted by Wise Medicare

Estimated Reading Time 3 minutes 9 seconds

Medicare Part B Premiums Headed Lower for 2023 – Here’s What You Need to Know

There is good news in store for Medicare Part B recipients in 2023, as premiums are due to drop by 3%, the first decrease in over a decade.

The Centers for Medicare & Medicaid Services (CMS) recently announced that the standard monthly premium for Medicare Part B coverage will go from $170.10 down to $164.90, a drop of $5.20.

Medicare Part B covers services such as physician appointments, outpatient hospital services, durable medical equipment, some instances of home health services, and additional medical and health services that are not covered by Medicare Part A.

Why are Medicare Part B Premiums Going Down?

The decrease is a result of a series of events over the past year.

To fully understand, we must first look back 12 months, to when CMS announced a $22 increase in Part B premiums for 2022. It was the largest annual increase in history, primarily due to anticipated higher healthcare spending as a result of a revolutionary new treatment for Alzheimer’s disease, called Adulhelm. The cost for one year of this treatment was estimated, at the time, to be $56,000.

Since that time, the manufacturer of the treatment, Biogen, cut the cost of Adulhelm treatment in half, down to $28,000 per year.

Then, on April 7, 2022, CMS announced that Medicare would only cover the treatments for those who participated in approved clinical trials. This means the number of people who qualify for Medicare to cover the cost of the treatment now shrinks drastically.

Combine the lower cost with the lower number of eligible recipients, and there was significant pressure on CMS to reduce premiums heading into 2023.

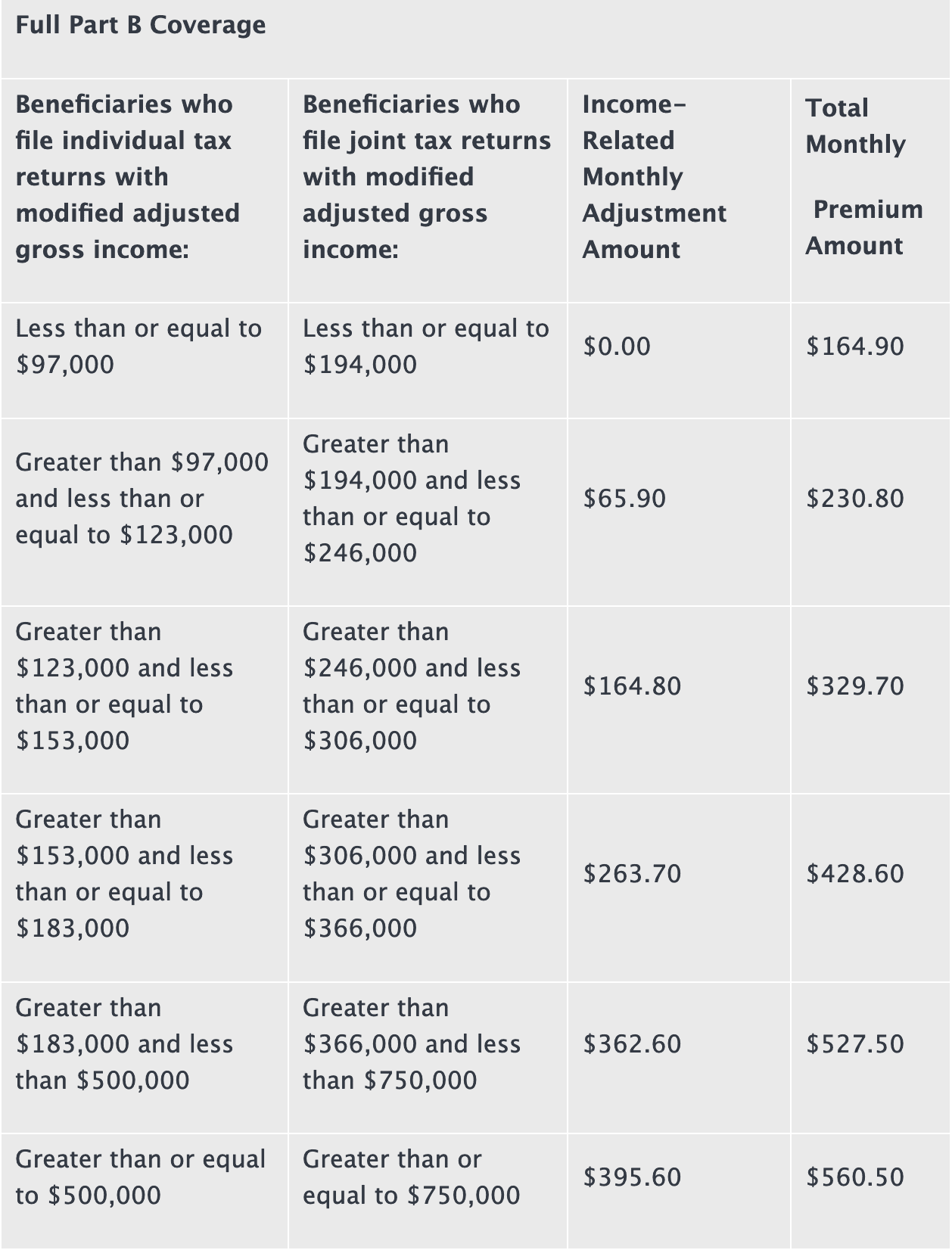

Here is a comprehensive look at Part B premiums for 2023, taking into account the Income Related Monthly Adjustment Amount (IRMAA):

Announcements were also made regarding premiums for Part A and D coverage.

Here is a Quick Overview of the Medicare Cost Changes for 2023:

- Medicare Part B and Part D premiums will be decreasing in 2023.

- Medicare Part A premiums, deductibles, and coinsurance costs are increasing in 2023.

- High-income premium brackets are increasing for Medicare Parts B & D: $97,000 in 2023 compared to $91,000 in 2022.

- Enrollment in Medicare Advantage is expected to go up in 2023, and the average premiums are decreasing.

- Medicare Advantage’s out-of-pocket cap is increasing to $8,300 in 2023 (although most plans have lower out-of-pocket costs).

- Previously, kidney transplant patients lost full Part B coverage 36 months after the transplant. Still, they now have the option to enroll in Part B coverage for life which includes coverage of immunosuppressive drugs.

Important Changes to Medicare Part A Deductible and Coinsurance Amounts

Medicare Part A provides coverage for hospital services, inpatient rehabilitation, hospice, skilled nursing facilities, and certain home health care services.

Most Part A beneficiaries do not have a Part A premium because they have worked at least 40 quarters of Medicare-covered employment during their lifetime. However, deductibles and coinsurance amounts do apply to hospital stays, especially when they are lengthy.

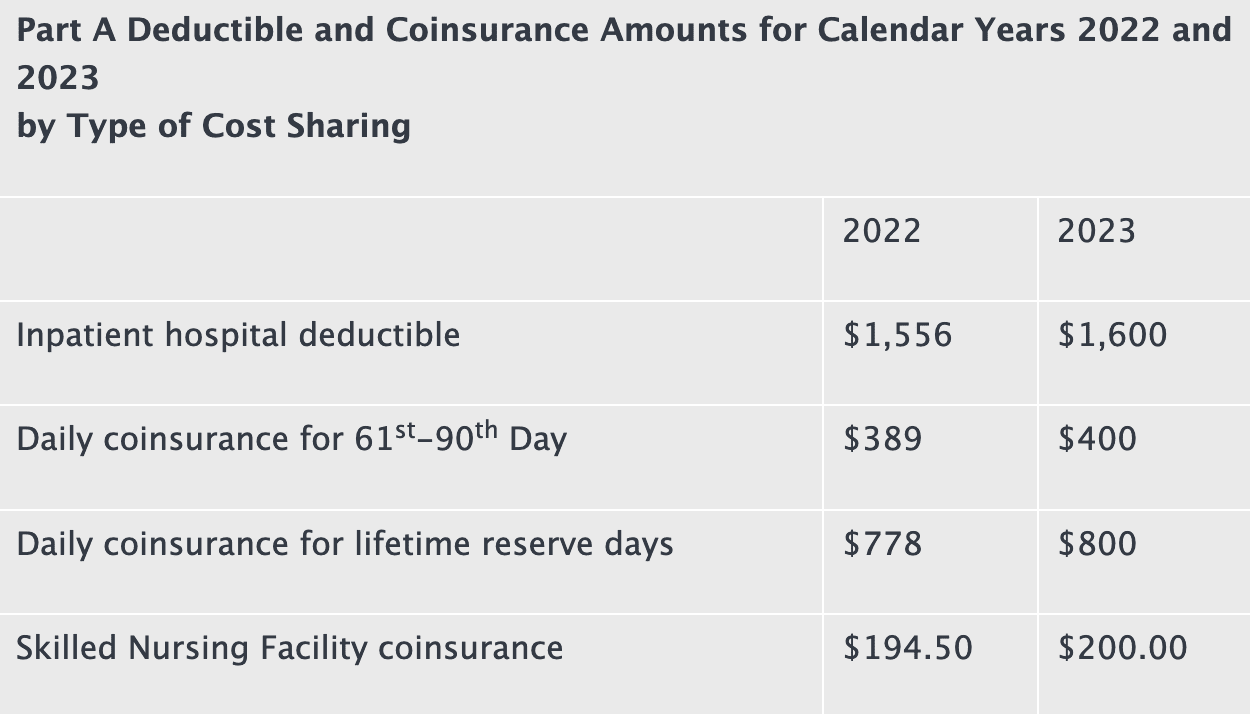

Changes in Part A Deductibles and Coinsurance Amounts for 2023 are as follows:

2023 Changes for Medicare Part D Coverage

Medicare Part D coverage (presctiption drug coverage) will also see some premium and deductible changes in 2023, but it is important to remember that cost adjustments are also dependent upon the beneficiary’s income.

Changes for 2023 include:

- Annual Deductible: The yearly deductible goes up to $505 in 2023, compared to the 2022 deductible rate of $480.

- Initial Coverage Limit: This limit is increasing in 2023 to $4,660, which is higher than the 2022 coverage limit of $4,430.

- Out of Pocket Threshold: In 2023, the out-of-pocket threshold is $7,400 per individual, which is an increase compared to the 2022 out-of-pocket threshold of $7,050.

- Minimum Cost Sharing for Catastrophic Coverage: 2023 pricing will be at $4.15 for generic/preferred multi-source medications, which is an increase compared to the 2022 rate of $3.95. All other drugs are priced at $10.35 in 2023, compared to $9.85 in 2022.

- Other Changes in Coverage: Costs for specific medications are changing in 2023. For example, Part D beneficiaries no longer need to pay for covered vaccines. Also, insulin will be available for a maximum cost of $35 per month.

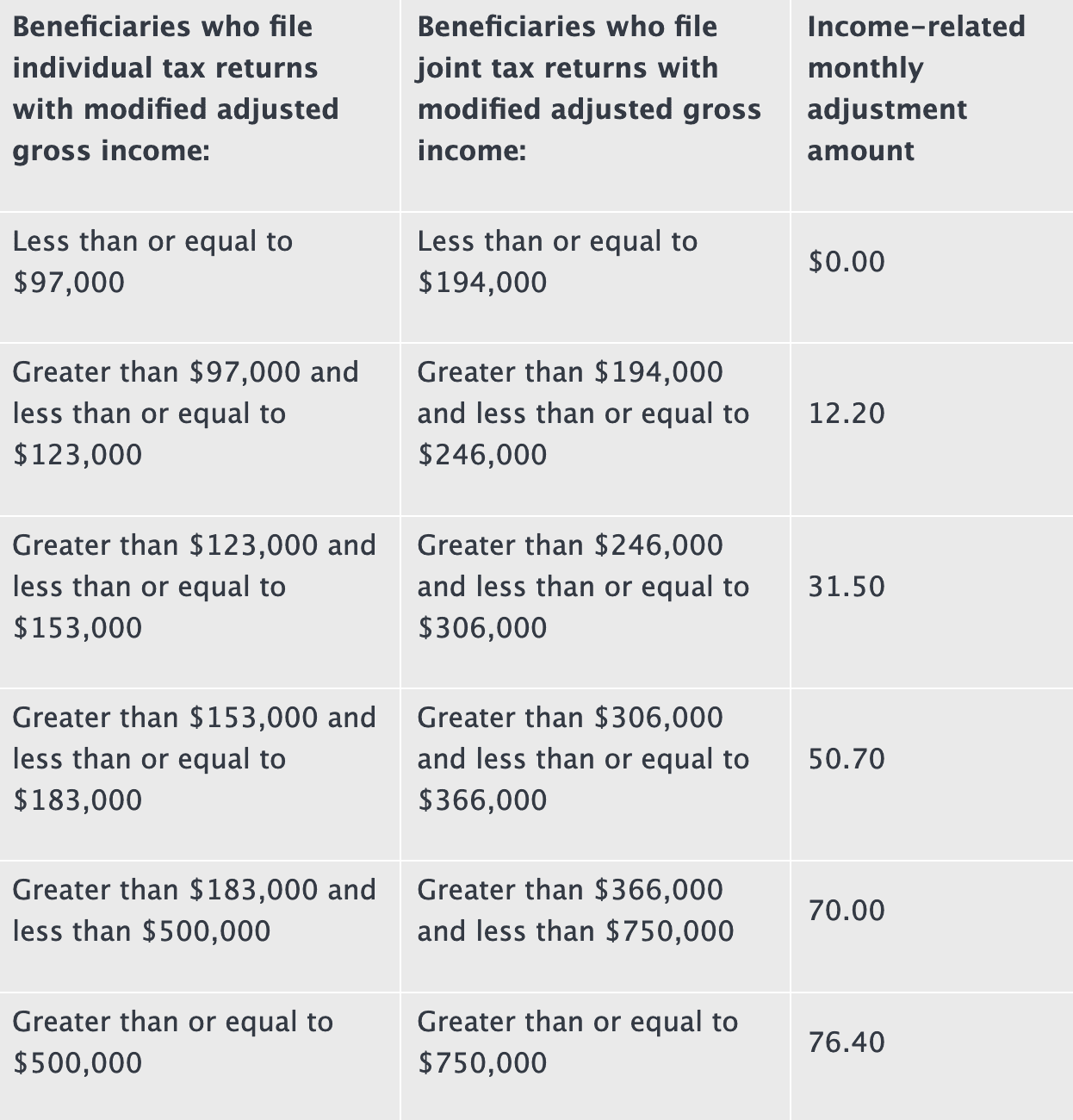

Income-related monthly adjustment amounts are as follows:

How to Get Free Assistance with Your Medicare Options for 2023

Understanding your Medicare coverage options, plans, premiums, deductibles, and co-pays can often be overwhelming. Our experienced team of licensed agents is certified to assist you with your options for 2023, and we provide this assistance at no cost to you.

Medicare’s Annual Enrollment Period runs from October 15 through December 7, 2023, and now is the time to become fully educated and make an informed decision with regard to your 2023 coverage.

Contact our office today to schedule an appointment and talk to one of our local, friendly, and licensed agents.

Wise MedicareNo-cost assistance with your Medicare enrollment and benefits.

- To speak with a licensed agent, call Springfield: (417) 755-7050 or Rolla: (573) 364-5446

(TTY 711 M-F, 8am-4pm)

- MO: 144875 | AZ: 5250189 | OK: 3000828470 | TX: 2506754 | CO: 655328 | FL: W639261

- 901 E St Louis St, Ste 1601

Springfield, MO 65806

and

708A N. Bishop Ave.

Rolla, MO 65401

Springfield Office:

Rolla Office:

Have You Watched Our Medicare Essentials Video Quick-Course?

This video tutorial covers the basic elements of Medicare in a format that is easy to understand and you can watch it from the comfort of home! It’s yours at no cost and no obligation, just tell us where we should send it!

Get Free Medicare Assistance

Friendly, licensed professionals are available to answer all of your questions. Call Springfield: (417) 755-7050 or Rolla: (573) 364-5446 or complete the form below and we’d be happy to reach out to you.